Tax and rebates for health insurance

HBF tax questions for members

We’ve answered our members’ most common questions about tax.

HBF tax statements: If you do your taxes online or through a registered tax agent, you no longer need an HBF tax statement. For this reason, we don’t automatically send HBF tax statements to members anymore. However, you can still download or request one. More details below.

Can I still get a copy of my tax statement?

If you’d like a copy of your tax statement for your records, from 3 July you’ll be able to download it by logging into myHBF or request it by calling us on 133 423.

When you log into myHBF you can download your tax statement using the following steps:

- Navigate to the drop-down arrow next to your name in top right-hand corner

- Select ‘Request a document’

- Select ‘Tax statement’ in the document type section

- Select the relevant financial year

- Select ‘Create tax statement’

Once you have requested or downloaded a copy of your tax statement via myHBF, you can also access it at your convenience through the HBF App:

- Select 'Cover' from the navigation bar at the bottom of the screen

- Select 'View my documents'

- Select 'Tax' from the drop-down menu

Please note that you will only be able to download the 2024/2025 tax statement from 3 July 2025.

Will I receive a tax statement for the 2024/2025 financial year?

We will send your tax statement information directly to the Australian Taxation Office (ATO). We will not be sending you a tax statement.

This is due to changes made by the Australian Government to make health insurance simpler. The changes made on 1 July 2019 mean you no longer need your tax statement to submit your tax return if you’re lodging it online or through a registered tax agent.

When will you send my tax statement information to the ATO?

What does this mean for my tax return?

If you lodge your tax return online through myTax or through a registered tax agent, your health insurance information should be pre-filled in your tax return. We will send the most up-to-date information to the ATO. You will need to check the pre-filled information and click to accept it.

If you believe the pre-filled health insurance information is incorrect or if you submit a paper tax return, from 3 July you’ll be able to download a copy of your tax statement by logging into myHBF or request it by calling us on 133 423.

How do I update my Australian Government rebate tier?

Do I still need to submit my tax return?

Where do I get help with my tax return?

If you need assistance with your tax return, please contact the ATO on 13 28 61 or visit the myTax website.

Can I get a statement to show what I've claimed during the year?

Yes, you can download a copy of your claims history statement by logging into myHBF or by calling us on 133 423.

When you log into myHBF you can download your claims history statement using the following steps:

- Navigate to the drop-down arrow next to your name in the top right-hand corner

- Select ‘Request a document’

- Select ‘Claims history’ in the document type section

- Select the member name and the relevant date range

- Select ‘Create document’

After you have requested or downloaded a claims history statement via myHBF, you can also access it at your convenience through the HBF App:

- Select ‘Profile’ from the nav bar at the bottom of the screen

- Select ‘View documents’ for all claims-related documents

How to read your tax statement

What does J mean?

Your share of the premiums that are eligible for the Australian Government Rebate. This amount excludes any Lifetime Health Cover loading you have paid (if applicable). Any adults covered on the policy when payments were made are allocated an equal share.

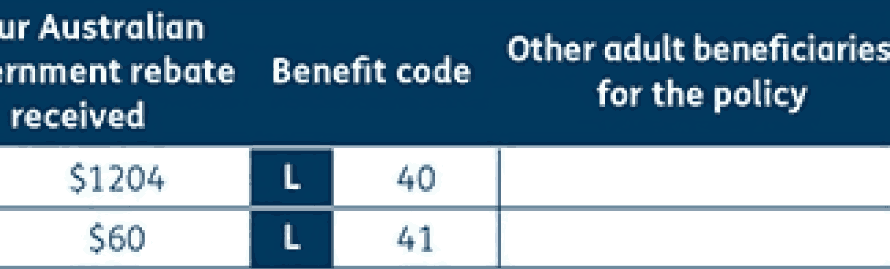

What does K mean?

The amount the Government has paid towards your share of the policy. If you're not registered for the Australian Government Rebate on private health insurance or are on Tier 3 of the ATO’s income bracket, this amount will be $0.

What does L mean?

This code represents the rebate you are entitled to, based on your age.

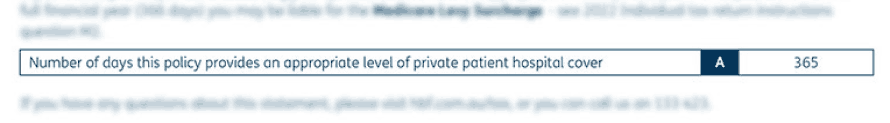

What does A mean?

The number of days you had private hospital cover in the last financial year. If this amount is less than 365 days (or 366 days in a leap year), and you earn above the income threshold, you may have to pay the Medicare Levy Surcharge.