Tax and rebates for health insurance

What is Lifetime Health Cover loading?

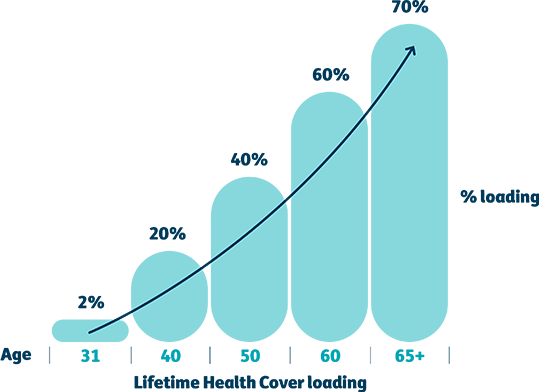

Lifetime Health Cover loading (LHC loading) is an extra cost applied to the price of hospital cover. Each year you wait to get hospital cover after the age of 31, you’ll pay an extra 2% for your cover. This extra cost is applied by the government, to encourage Australians to get hospital cover earlier in life.

If you get hospital cover before you’re 31, you’ll avoid paying higher premiums.

How does the LHC loading work?

If you don’t have hospital cover by 1 July following your 31st birthday, you’ll pay an extra 2% for each year you wait.

The loading is capped at a maximum of 70%.

If you’re over 31 and have never had hospital cover, you’ll most likely pay the extra cost. But you can avoid paying even more if you get hospital cover now.

There are special circumstances where you’d be exempt from LHC. Head to the Private Health Insurance Ombudsman to find out more.

Lifetime Health Cover loading explained

Frequently asked questions

My 31st birthday falls in the first half of the year. What date do I need to purchase hospital insurance by to avoid the lifetime health cover loading?

Say your 31st birthday is on the 21st April 2021 - you have until the 1st July 2021 to buy hospital insurance and avoid the loading.

My birthday falls in the second half of the year. What date do I need to purchase hospital insurance by to avoid the lifetime health cover loading?

Say your 31st birthday is on 25 October 2021 - you have until 1 July 2022 to buy hospital insurance and avoid the loading.

I'm over 31 and the Lifetime Health Cover loading has already been applied to me. Do I need to purchase hospital insurance?

If you're 31 or older and don't have hospital insurance, it's still a good idea to buy it as soon as possible. This is because the Lifetime Health Cover loading (LHC) goes up by 2% every year that you don't have hospital cover, up to a maximum of 70%. For example, if you get hospital insurance at 41, you'll pay an extra 22% on top of the base cost of your premium, so long as you maintain your cover.

The good news is that the LHC loading doesn't last forever — once you've held hospital insurance for a continuous 10 years, the loading is removed.

Just remember, the LHC loading only applies to hospital cover; it does not apply to extras, urgent ambulance or overseas visitors' insurance. For example, if you buy hospital insurance in addition to extras or urgent ambulance insurance, you'll only pay the LHC loading on the hospital insurance portion of your premium.

If the Lifetime Health Cover loading applies to me, will the loading affect other people on my couple's or family policy?

For couples and families, the Lifetime Health Cover loading is calculated as an average between the two adults. For example, if one person has a 40% loading and the other person has a 10% loading, the loading applied to the couple's policy is 25%.

Will the lifetime health cover loading still apply if I switch health funds?

Yes, your lifetime health cover loading status stays the same even when you switch health funds.