How to check if you’re covered

Get the most from your HBF health membership by knowing exactly what you’re covered for.

See more helpful articles in Membership & claims:

Check your cover online

Alternatively, you can visit your nearest branch or call us on 133 423.

Review your product sheet

Check your waiting periods

Check your extras limits and usage

Ready to claim

Now that you know what you’re covered for, you’re ready to claim.

Ask us for a benefit quote

If you have an upcoming treatment or service, we recommend contacting us first to check your cover. We'll confirm what you're covered for and any out-of-pocket costs you may need to pay.

Call 133 423 or visit a branch for a medical or extras benefit quote.

What details do I need to provide?

Medical benefit quote

- Patient name

- Admission date

- Discharge date

- Hospital name

- Surgeon name and/or provider number

- Assistant name and/or provider number, if applicable

- Anaesthetist name and/or provider number

- Prosthesis rebate code(s)

- MBS items and charges

Extras benefit quote

- Patient name

- Treatment/service date

- Item number(s)

- Associated charges

- Provider number(s)

- Tooth number(s), if applicable

This information should be listed on your provider quote(s). If you don’t have this information, please contact your provider.

Frequently asked questions

When can I start using my hospital insurance?

When you buy hospital insurance for the first time or after not having it for a long time, or you upgrade to include a new service, there will generally be a waiting period you need to serve before you can claim.

At HBF, waiting periods for hospital insurance are as follows

When can I start using my extras insurance?

When you buy extras insurance for the first time, there will generally be a waiting period you need to serve before you can claim if you haven't had continuous cover, or if you've just upgraded to a higher level of cover.

What is a benefit?

A benefit is the amount you can claim back for a service from your health fund.

What is a waiting period?

A waiting period is a period of time during which you must hold continuous membership under a particular health cover before you are entitled to receive a benefit at the level payable on that cover. You can claim benefits applicable on your level of cover for services or treatment you receive after you have served your waiting periods.

Waiting periods applicable on your level of cover are listed on the relevant product sheet.

What is a lifetime limit?

A lifetime limit is the total amount you can claim for a service over the course of your lifetime; each person on your policy has their own lifetime limit. At HBF, lifetime limits only apply to orthodontics on select covers. This means that once you've claimed up to your lifetime limit, either at HBF or through claims at another health insurer, you won't be able to claim benefits again even if you change your cover or leave and re-join us in the future.

What is an annual limit?

An annual limit is the maximum amount of money you can claim for a service within a calendar year. Each person on your policy has their own annual limits.

Explore our Help Centre

Health insurance explained

Gold, Silver, Bronze and Extras cover explained, what is an excess and more.

Manage your membership

Access your cover online, order a member card, manage members on your policy and more.

Membership & claims

Making claims, managing your cover, updating payment details and more.

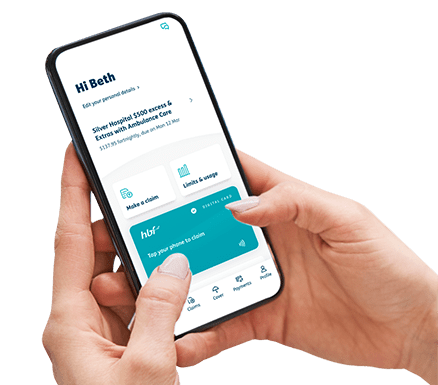

Manage your cover with the HBF App.